Blog

Create revenue with the effective use of multichannel customer data in 3 steps

Digitalization and global competition is changing the business environment. It is therefore a must for B2C businesses to utilize their customer data to the maximum. Here are the three steps that enable you to do so:

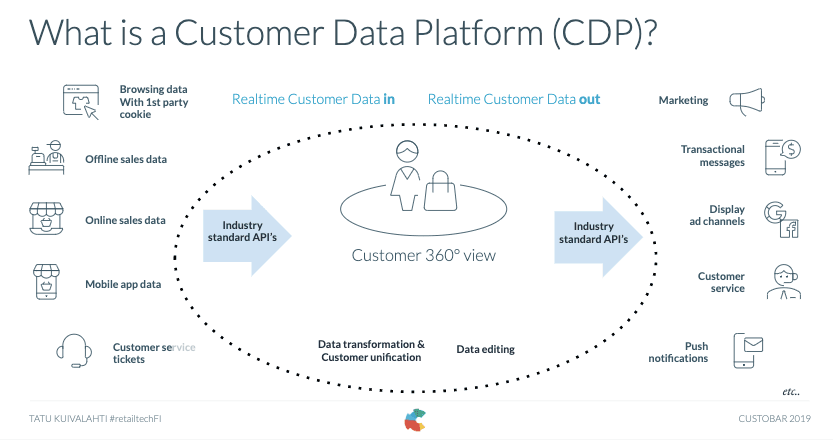

1. Use a customer data platform (CDP) to unify all your customer related data from online and offline sales, customer service tickets, mobile app data, etc.

CDPs are still somewhat confused with CRM (customer relationship management) systems. A CDP and a CRM system can co-exist, even on top of each other. However, they are not synonymous. CDPs create a unified customer database from all data coming in from multiple sources, a customer 360° view. Furthermore, CDPs can process fast tempo data that CRMs cannot, such as a customer’s web browsing, mobile app usage and marketing impressions. This cleaned, combined, edited and structured data is then made available for marketing via real-time, industry standard APIs.

2. Utilize the collected data by personifying your marketing messages.

Gathering your data all in one place, your CDP, is just a good foundation to build on. It’s the basis for segmented and insightfully targeted customer communications and marketing messages across your channels, including email, SMS, Push notifications, website/ecommerce site and any other channel over APIs. Shopping and browser histories are examples of creating specific customer segments that can accurately anticipate the customer’s future buying patterns. Your customers’ activity vs passivity - that is, buying frequency, may be another good axis for customer segmentation and one which you can easily access with the help of our RFM matrix.

Targeting rules (parameters) may include AI and forms of machine learning in buyer behaviour predictions and various product recommendations. In all of the above examples, it pays to do a series of smaller tests and then automate the messages with high conversion rates.

3. Capitalize on your multichannel customer data with targeted display ads.

Browsers have significantly restricted the use of 3rd party cookies. In practice this means that identifying customers for display ads is becoming more difficult with cookies. Custobar CDP and marketing automation has a solution to tackle these restrictions. We can integrate via APIs with display ad networks, such as Google ads, and utilize a customer match feature to create dynamic segments. For example, cross-platform advertising networks cannot typically access the offline store data. However, using Custobar and customer match you can get the offline purchase segments available for display ads.

If you would like to find out more about how enriched customer data creates revenue, take a look at case Ströh. Ströh gained a 62% increase in their year over year repurchase rate since they began using Custobar. It’s all about personifying your customer data and making sure your marketing communications are well segmented and accurately targeted.

This blog post belongs to the #retailtechFI series. It is based on the presentation given in the event of changes in retail marketing that was hosted by Custobar, Sniffie Software, Woolman, and Custobar’s partner, Google. Our post Retail marketing is changing - are you keeping up? posed a few questions by the audience we promised answers to later. Here is one question and answer:

Q: How will customers be identified in retail (in brick and mortar stores) in the future? Will AI and face recognition be the identification method, and are they in fact already here?

A: We at Custobar have listed 12 different ways to identify a customer in the store. Obviously, there are the traditional plastic loyalty cards but they are losing popularity. We have developed an innovative and simple solution, a Custobar add-on, called mobile loyalty card. It stores the customer’s loyalty card into the mobile phone using a personalized link provided with an automated SMS message to the customer.

Join the #retailtechFI conversion on LinkedIn and other social medias!

Tatu Kuivalahti

CEO, Custobar Ltd.